A New Year – A New Green Path: China’s New ETS

China kicked off 2018 with three “green” policies: the debut of a national emissions trading scheme (Dec 19, 2017), the official start to the ban on ivory trade (January 1, 2018) and a new tax on polluters (January 1, 2018).

Throughout January, we’ll explain each policy and we’re focusing first on China’s national emissions trading scheme (ETS).

As China is the world’s highest carbon emitting country, its emissions trading scheme (ETS) is also one of the world’s largest. Superlatives aside, China’s ETS, currently limited to those companies in the power sector, will be finalizing regulations in 2018 and 2019 and is expected to be fully operable in 2020. [1] Experts agree that the carbon price is the key – without proper incentives to buy or sell carbon credit, companies won’t adjust their polluting habits. [2]

Under its cap-and-trade format, the ETS lets companies that exceed their quota of carbon emissions purchase a carbon credit from companies that have not reached the emissions cap.

Source: GEI 2018

The second important aspect of the ETS success is the companies included in the ETS – specifically whether or not the companies included have significant negative environmental impact.

According to the National Defense and Reform Commission (NDRC), the ETS will include 1,700 companies in the initial launch, and over 7,000 companies qualify to be included when the ETS expands. [1]

Overall, NDRC expects for the ETS to “affect” – essentially reduce – more than 3 billion metric tons of carbon dioxide. [2] The ETS will at first include only companies in the power sector, which account for 46% of China’s emissions, and according to research by the World Resource Institute, 39% of these emissions will be covered by the ETS. [3]

Trends in Carbon Pricing

Source: Future 500

China has been developing the ETS and fine-tuning its pricing mechanism for several years. In fact, the country launched seven pilot projects in 2012, with all successfully completing their first compliance by June 2015.

The 7 Pilot Emission Trading Systems were in Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen. [4] These 7 pilot sites were chosen for two reasons: first, they thrive on emissions-heavy industries like cement, electricity, heat, petroleum and oil extraction, and second, they cumulatively represent 25% of China’s total GDP. [4]

The scope of the announced ETS and price of carbon are based on the pilot projects, the success of which suggests that potential profits are considerable. In fact, as September 2017, China’s pilot ETS had total transaction values of around 4.5 billion RMB. [2]

Official carbon price data since 2013 of China’s pilot ETS systems; each pilot project (by city) sets its own price.

Translation by GEI; Source: Tanjiaoyi 2018

According to the Climate Action Programme: “The launch prices will be set as the average of the prices on China’s seven trial carbon markets (about 30 yuan per tonne) – between 1.2 and 8 billion yuan ($0.17-1.16 billion) of over-the-counter trading yearly. Other products will be introduced on the new carbon market after 2020 including carbon futures, and the market trading is expected to expand to 60 to 400 billion yuan ($7-58 billion) per year.” [1]

The scale of the pilot projects is more extensive than the announced ETS – a major point of criticism for some experts. [2] The Washington Post and Bloomberg say that by initially limiting the ETS to coal-fired power plants and other power generators, some environmentally-perilous industries – like cement, aluminum and other non-ferrous metals – maybe under less stress to reduce their emissions. [6]

Photo Credit: Carbon Brief

Chinese officials explained that the edits to the pilot project came from concerns of “statistical foundations” and that the system would require “constant testing and continuous adjustments.” [3]

At COP23 in Bonn, XIE Zhenhua, China’s special representative for Climate Change, explained: “Carbon futures trading will not be available at the launch stage of the scheme… {The ETS} is intended to create a cost for emitting carbon, not a platform for market speculation.” [3]

China’s special represenative for Climate Change, Minister XIE Zhenhua

Photo Credit: IISD Reporting Services

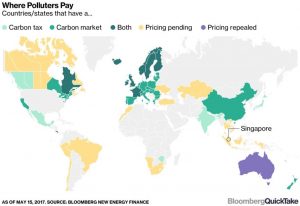

Even with the scale back from the pilot program, China’s ETS is still a significant step forward and raises the bar for global carbon markets. China’s ETS is expected to be larger than that of the European Union, which only encompasses 2 billion metric tons of CO2 [5] and is one of just a few established carbon taxes or markets in the world.

Source: Bloomberg New Energy Finance,

via The Washington Post (Dec. 28, 2017) [6]

Moving forward, we’ll watch how the scale of the ETS changes. From GEI’s point of view, the ETS is a positive step as it connects China’s environmental goals with market incentives. Market mechanisms like these have potential to usher in the most effective and sustainable solutions of all.

[1]http://www.climateactionprogramme.org/news/china_to_open_first_national_carbon_market

[2]https://www.bloomberg.com/news/articles/2017-12-19/china-unveils-plan-for-world-s-biggest-carbon-trading-market

[3]http://www.climatechangenews.com/2017/12/14/china-launch-nationwide-carbon-market-next-week-officials/

[4]http://www-assets.vermontlaw.edu/Assets/elc/Parenteau.March2016.pdf

[5]https://www.nytimes.com/2017/12/19/climate/china-carbon-market-climate-change-emissions.html

[6]https://www.washingtonpost.com/business/why-chinas-big-step-on-carbon-isnt-bigger-still-quicktake-qanda/2017/12/28/ae30fd3a-ec4f-11e7-956e-baea358f9725_story.html